Whirlpool anuncia criação de metas de valor a longo prazo com base no desempenho recorde com apresentação de resultados sólidos no terceiro trimestre

- Objetivo de aumento das metas de criação de valor de longo prazo;

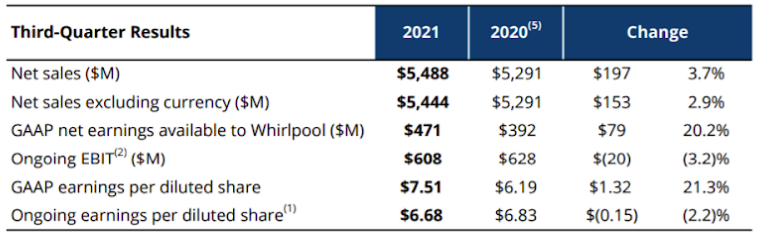

- Crescimento das vendas líquidas no terceiro trimestre de ~ 4%, impulsionado por iniciativas de preços baseados em custos e uma contínua demanda ao consumidor;

- Margem de lucro líquido GAAP forte de 8,6% (alta de 120 bps) e margem de EBIT (2) contínua muito forte (não-GAAP) de 11,1% (queda de 80 bps), compensando em grande parte 650 bps da inflação de matéria-prima;

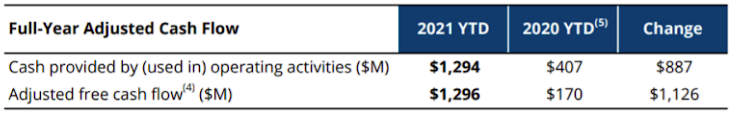

- O lucro gerado pelas atividades operacionais aumentou em 887 milhões de dólares americanos, impulsionado por fortes ganhos; o fluxo de caixa livre ajustado (4) melhorou em1.126 milhões de dólares impulsionado por fortes lucros e positivamente impactado pelos desinvestimentos da Whirlpool China (6) e a subsidiária da Turquia

- Voltou a comprar 441 milhões de dólares em ações durante o trimestre;

- Aumento do lucro por ação diluída para o ano inteiro de 2021 para 27,80$ numa base GAAP e ~ 26,25$ numa base contínua (1); o lucro gerado pelas atividades operacionais de 1,95 mil milhões de dólares e o fluxo de lucro ajustado (4) de 1,70$ mil milhões de dólares permanecem inalterados.

BENTON HARBOR, Mich., outubro, 2021 - A Whirlpool Corporation (NYSE: WHR), continua comprometida em ser a melhor empresa a nível mundial de cozinha e lavandaria, divulgou os resultados financeiros do terceiro trimestre de 2021.

"Anunciámos as nossas metas de criação de valor de longo prazo, assim como aumentámos a nossa orientação de lucro por ação para ~26,25$ ", referiu Marc Bitzer, presidente e CEO da Whirlpool Corporation. "Temos e continuaremos a apresentar um forte desempenho num ambiente desafiador. "

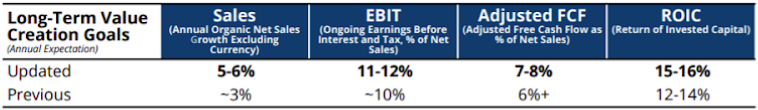

LONG-TERM VALUE CREATION GOALS

Reconciliations to the equivalent GAAP measures -- net sales, net earnings, cash provided by (used in) operating activities, and return on assets -- for the metrics below are not provided as they rely on market factors and other assumptions outside of our control.

- Strong brand portfolio and compelling innovation pipeline position us to capitalize on positive demand trends across housing, increased appliance usage, e-commerce and D2C

- Low fixed cost base structurally positioned to expand margins and grow profitably

- Earnings growth and strong working capital discipline will drive delivery of adjusted free cash flow and our continued commitment to create shareholder value

KEY RESULTS

CASH FLOW

QUARTERLY HIGHLIGHTS

- Delivered Q3 GAAP earnings per diluted share of $7.51 and ongoing (non-GAAP) earnings per diluted share(1) of $6.68, both driven by strong top-line growth and cost-based pricing actions; GAAP earnings per diluted share also impacted by the gain resulting from our additional investment in Elica PB India(7)

- Significant cash generated by operating activities of $1,294 million driven by strong earnings; adjusted free cash flow(4) of $1,296 million driven by strong earnings and positively impacted by the divestitures of Whirlpool China(6) and Turkey subsidiary

"We continue to strengthen our balance sheet with exceptional cash generation,” said Jim Peters, chief financial officer of Whirlpool Corporation. “We are on track to deliver yet another record ongoing earnings per share and expect to return over $1.2 billion to shareholders in 2021.”

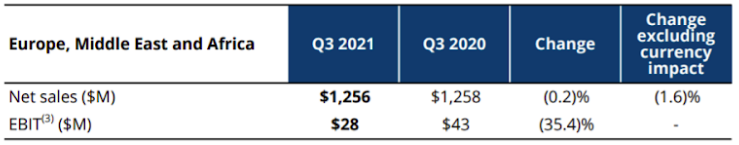

REGIONAL REVIEW

- Stable year-over-year top-line driven by cost-based pricing actions offset by supply constraints

- EBIT margin(3) of 2.2 percent, compared to 3.4 percent in the same prior-year period, impacted by inflation, partially offset by cost-based pricing actions

“We are pleased to have delivered profitable results in an inflationary environment, and increased Q3 net sales by 15% compared to 2019,” commented Gilles Morel, President Whirlpool EMEA and Executive Vice President of Whirlpool Corporation. “Our continuing innovation in our products and our operations gives us confidence in the resilience of our business and our long term success."

FULL-YEAR 2021 OUTLOOK

- Expect full-year 2021 net sales growth of ~13 percent

- Increased GAAP earnings per diluted share to ~$27.80 from ~$26.95, driven by the gain resulting from our additional investment in Elica PB India(7) and lower restructuring charges

- Increased ongoing earnings per diluted share(1) to ~$26.25

- Cash provided by operating activities of $1.95 billion and adjusted free cash flow(4) of $1.70 billion remain unchanged

- GAAP tax rate of 22 to 24 percent and adjusted tax rate (non-GAAP) of 24 to 26 percent remain unchanged